7 Easy Facts About Financial Education Explained

Wiki Article

The smart Trick of Financial Education That Nobody is Talking About

Table of ContentsFinancial Education - The FactsAll About Financial EducationA Biased View of Financial EducationThe Definitive Guide for Financial EducationNot known Factual Statements About Financial Education The Basic Principles Of Financial Education The smart Trick of Financial Education That Nobody is DiscussingHow Financial Education can Save You Time, Stress, and Money.3 Simple Techniques For Financial Education

Without it, our economic decisions and the activities we takeor don't takelack a strong structure for success.With each other, the populations they offer period a broad variety of ages, revenues, and backgrounds. These instructors witness first-hand the impact that monetary literacyor the absence of financial literacycan have on a person's life.

All About Financial Education

Our group is pleased to be producing a new paradigm within higher education and learning by bringing the subject of money out of the shadows. "Finances inherentlywhether or not it's unbelievably temporary in simply purchasing lunch for that day or long-term saving for retirementhelp you complete whatever your objectives are.Each year because the TIAA Institute-GFLEC study began, the ordinary percent of concerns addressed correctly has increasedfrom 49% in 2017 to 52% in 2020. While there's more work to be done to enlighten consumers concerning their financial resources, Americans are relocating in the best instructions.

The Facts About Financial Education Uncovered

Do not let the anxiety of delving into the financial world, or a sense that you're "just bad with cash," stop you from boosting your financial knowledge. There are little steps you can take, as well as sources that can assist you along the road. To begin, make the most of cost-free devices that could currently be readily available to you.Numerous financial institutions and also Experian additionally supply free credit report surveillance. You can use these devices to obtain a first understanding of where your cash is going as well as where you stand with your credit. Figure out whether the company you benefit offers totally free financial counseling or a staff member economic health care.

Financial Education for Beginners

With an excellent or superb credit scores score, you can get lower rate of interest on lendings and charge card, credit history cards with attractive and also money-saving rewards, as well as a variety of deals for monetary products, which provides you the chance to choose the ideal offer. Yet to improve credit, you need to recognize what factors add to your score. Best Nursing Paper Writing Service.This new situation is resulting in greater unpredictability in the financial environment, in the monetary markets and, certainly, in our very own lives. Nor must we forget that the crisis resulting from the pandemic has checked the of representatives and also family members in the.

Financial Education Things To Know Before You Buy

As we pointed out earlier, the pandemic has actually additionally boosted the usage of digital channels by citizens that have not always been digitally and economically equipped. Furthermore, there are also sectors of the populace that are less aware of technological advancements and are therefore at. Including in this issue, in the wake of the pandemic we have actually also seen the decrease of physical branches, specifically in backwoods.One of the best gifts that you, as a parent, can offer your youngsters is the cash talk. And also similar to with that other talk, tweens and teenagers aren't constantly you could check here responsive to what moms and dads have to saywhether it has to do with consent or substance rate of interest. But as teens come to be a lot more independent and think about life after high college, it's just as essential for them to find out about monetary literacy as it check this site out is to do their very own laundry.

Financial Education for Dummies

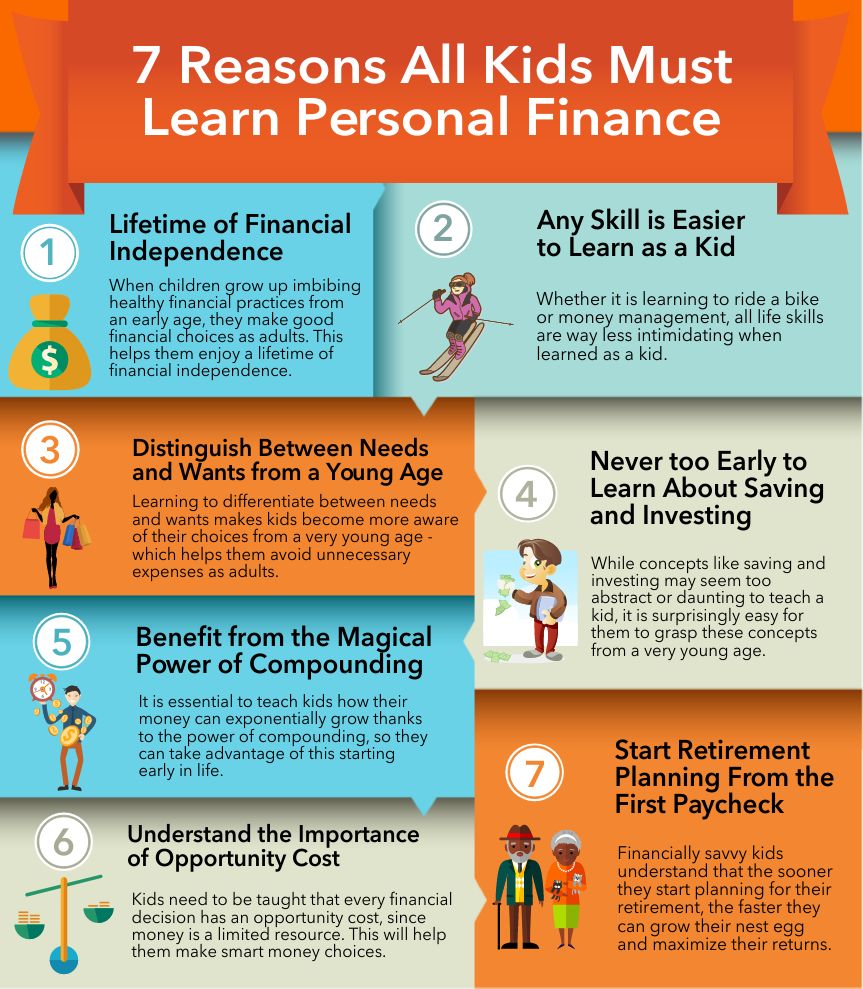

Knowing exactly how to make sound cash choices now will aid offer her explanation teens the self-confidence to make better decisions tomorrow. Financial literacy can be defined as "the capability to make use of expertise as well as abilities to handle economic resources effectively for a lifetime of economic well-being." In other words: It's understanding just how to conserve, grow, as well as secure your money.And like any ability, the earlier you discover, the more proficiency you'll acquire. There's no better area to talk about useful money abilities than in the house, so kids can ask questionsand make mistakesin a safe room. Nevertheless, no person is extra thinking about kids' economic futures than their moms and dads.

Financial Education Can Be Fun For Anyone

By instructing youngsters concerning cash, you'll aid them find out just how to balance needs and wants without going into debt. Older teens may want to go on a trip with pals, yet with even a little economic proficiency, they'll understand that this is a "want" they might require to spending plan and also conserve for.

Little Known Questions About Financial Education.

, instead of providing an automated "no," assist them understand that it's not free cash.

Fascination About Financial Education

Report this wiki page